If you’re juggling multiple student loans, you might be feeling overwhelmed by the different interest rates, repayment schedules, and due dates. Loan consolidation can offer a way to simplify things and even save you money in the process.

However, consolidating your student loans requires understanding how it works and whether it’s the right choice for your financial situation.

In this guide, we’ll break down everything you need to know about student loan consolidation, how it works, the benefits and drawbacks, and how you can save money on interest in the process.

What Is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple federal or private student loans into a single new loan. This new loan will have a single monthly payment and a single interest rate, which makes it easier to manage.

The new interest rate is typically a weighted average of the interest rates on your original loans, rounded up to the nearest one-eighth percent.

There are two main types of student loan consolidation:

Federal Student Loan Consolidation: This involves combining multiple federal student loans into a Direct Consolidation Loan. This is typically a no-fee service offered by the U.S. Department of Education.

Private Student Loan Consolidation: If you have private student loans, you can consolidate them with a private lender, often called refinancing. This can offer the potential for a lower interest rate, but you may lose access to federal protections like income-driven repayment plans and loan forgiveness options.

How Does Student Loan Consolidation Work?

1. Federal Student Loan Consolidation

Process: The U.S. Department of Education offers a Direct Consolidation Loan for federal loans. The process involves combining your eligible federal student loans into one loan, and you’ll make a single monthly payment to one servicer.

Interest Rate: The interest rate on a Direct Consolidation Loan is a weighted average of the interest rates on the loans being consolidated. However, the rate is rounded up to the nearest one-eighth percent. Importantly, consolidation does not reduce your interest rate.

Repayment Terms: You can choose a repayment plan based on your income and financial situation, including standard repayment, extended repayment, or income-driven repayment plans.

2. Private Student Loan Consolidation (Refinancing)

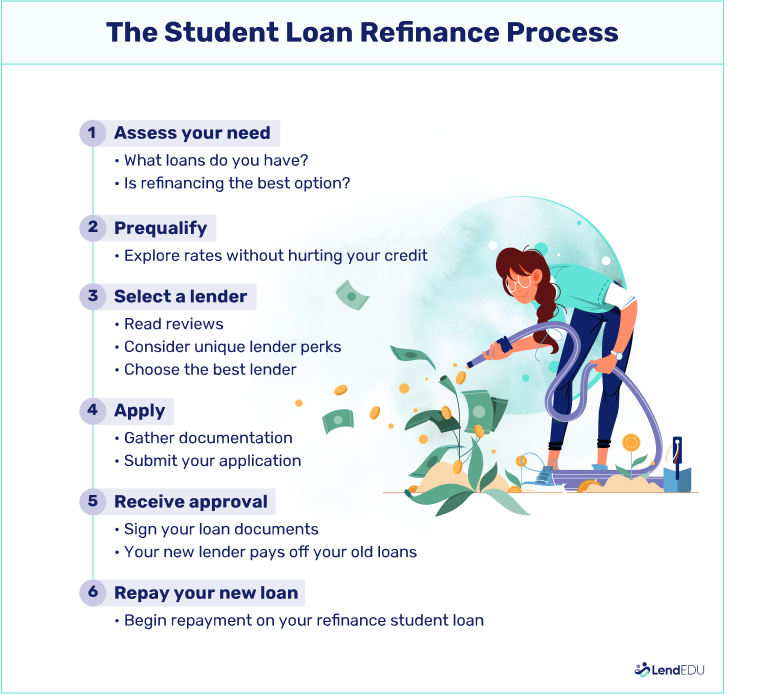

Process: Private student loan consolidation, or refinancing, involves taking out a new loan with a private lender to pay off your existing student loans. The new loan can combine both federal and private loans, and the terms are set by the private lender.

Interest Rate: This is where refinancing can really save you money. If you have a good credit score and a stable income, you may qualify for a lower interest rate than what you’re currently paying. This can reduce the total amount of interest you’ll pay over the life of the loan.

Repayment Terms: Private lenders will offer various repayment terms, and you can usually choose between fixed and variable interest rates. A lower interest rate can significantly reduce your monthly payments and overall debt.

Benefits of Consolidating Student Loans

Simplified Payments: Consolidation allows you to combine multiple loans into a single loan with a single monthly payment. This can help reduce confusion and make budgeting easier.

Potential Lower Interest Rate (for Private Loans): If you qualify for refinancing through a private lender, you may be able to lower your interest rate, which can save you money in the long run. Refinancing is ideal for borrowers with good credit and a steady income.

Flexible Repayment Plans (for Federal Consolidation): When you consolidate federal loans, you can select a repayment plan that works best for your financial situation, including income-driven repayment plans. This can make it easier to manage your monthly payments, especially if you have a fluctuating income.

Access to Alternative Loan Forgiveness (for Federal Loans): Consolidating federal loans does not eliminate your eligibility for certain federal loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), as long as you meet the necessary criteria.

Fixed Monthly Payment: Both federal and private consolidation typically offers fixed monthly payments. With a fixed payment, you don’t have to worry about interest rates rising and causing your payments to increase over time.

Drawbacks of Consolidating Student Loans

Loss of Federal Loan Benefits (for Private Consolidation): If you consolidate federal student loans with a private lender, you will lose access to federal protections, such as income-driven repayment plans, loan forgiveness programs, and deferment or forbearance options.

May Not Reduce Interest Rates (for Federal Consolidation): With federal consolidation, the interest rate is a weighted average of your existing loans’ rates. This means you likely won’t see a reduction in your interest rate, and it could even result in a slightly higher rate due to rounding. This can increase the total amount you pay over the life of the loan.

Longer Repayment Period: Consolidation could extend your repayment term, which may lower your monthly payment but also result in you paying more interest over time. It’s important to find a balance between a manageable monthly payment and paying off your loan in a reasonable time frame.

No Immediate Savings (for Federal Consolidation): Federal consolidation may not lead to immediate savings because of the average weighted interest rate. If your primary goal is to reduce your interest rates, refinancing with a private lender might be the better option.

How to Consolidate Student Loans and Save Money on Interest

To save money on interest through consolidation, consider the following strategies:

1. Refinance Your Loans with a Private Lender

- If you have good credit, you can refinance your student loans through a private lender at a lower interest rate. This could save you a significant amount of money in the long term, especially if you qualify for a lower rate than your current federal loans or private loans.

- Consider refinancing if you can afford a stable payment and don’t need access to federal protections like income-driven repayment plans or forgiveness programs.

2. Focus on Paying Off High-Interest Loans First

- If consolidating doesn’t significantly lower your interest rate, focus on paying off loans with higher interest rates first. This can help minimize the overall interest paid, even if the consolidation doesn’t reduce the rate significantly.

- Make additional payments to reduce the principal of high-interest loans faster, as this will reduce the total interest over time.

3. Choose a Shorter Repayment Term

- When consolidating or refinancing, consider selecting a shorter repayment term, such as 10 years instead of 20 years. While this will increase your monthly payment, it will reduce the overall amount of interest you pay in the long run.

- Refinancing with a shorter term may lead to a slightly higher monthly payment, but the savings from paying less interest will make it worthwhile.

4. Explore Income-Driven Repayment Plans (for Federal Loans)

- If consolidating your federal loans, consider enrolling in an income-driven repayment plan. These plans set your monthly payment based on your income and family size, which can reduce the payment amount and save you money if your income is lower.

Conclusion

Consolidating your student loans can simplify your payments and help you manage your debt, but it’s important to weigh the pros and cons before making a decision. While consolidating federal loans can help you access flexible repayment options, it’s unlikely to save you money on interest unless you refinance through a private lender. If saving money on interest is your main goal, refinancing with a private lender may be the best option—especially if you have good credit and a steady income.

Before making a decision, carefully assess your financial situation and long-term goals. Student loan consolidation can be a great tool for simplifying debt, but it’s essential to choose the option that best aligns with your needs and helps you save money in the process.